A guide to effectively tailoring standards

Countless meetings are spent answering questions about Enterprise Architecture (EA) terminology, like: ‘What is a capability’, or ‘How do we define an application’. These conversations are a frequent time-sink as many reading this will know.

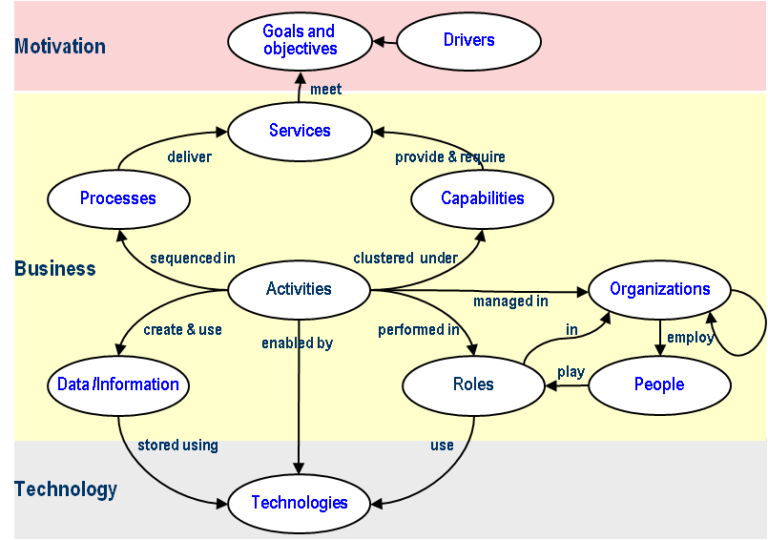

A recent article presents an eloquent solution. Conceptualizing an enterprise as a system by Graham Berrisford addresses how hundreds of standards prescribe overlapping metamodels for EA, and the challenges this presents. His easily digestible EA concept graph provides a powerful starting point for an EA repository schema (below).

It’s rare to find organizations adopting a single metamodel and for good reason: this approach is prone to failure and sleepless nights. A more typical, and dynamic approach is to take a standard or two and tailor them to meet the specific needs of the organization.

But what is the best approach and what are the downstream impacts?

Accept that there is no silver bullet

What works for one organization, won’t work for another. Often the right answer is to find something everyone can agree on.

Any approach can work well for a single architect or a small team. But for larger organizations, it’s best to use well-defined standards and adjust them to ensure a good fit. What would this approach entail?

How organizations tailor standards

Commonly, tailoring standards come in two forms:

1. Turn off what you don’t need

Most organizations don’t need every viewpoint, object, relationship, and piece of metadata a standard prescribes. So they turn off what they don’t need, and reintroduce them as necessary.

2. Merge Standards

Each standard has its strengths – for example, TOGAF’s ADM, and ArchiMate’s relationships. Sure, you benefit from the strengths of each standard when you merge them, but this comes at a high price: it’s a complex procedure, often leading to time-consuming debates.

The more standards being merged the bigger the headache.

You can’t do that! – Escaping the constraints of legacy EA tools

To avoid being constrained by downstream technicalities (like EA software), decisions and discussions about standards should come before deciding where to put them.

Legacy EA tools are a bottleneck for the best decisions tailored to a business’s ever-changing needs since implementing bespoke standards isn’t possible without a great deal of labor. Unfortunately, they end up limiting the potential of tailored standards.

Tools like Enterprise Insight were born out of a need to meet these challenges, allowing architects to implement virtually any metamodel setup with pre-configured standards out of the box and metamodels can easily be used together.